does california have an estate tax in 2021

Does california have an estate tax in 2021. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider.

There are no estate or inheritance taxes in California.

. Income is distributed to a beneficiary. The increase in the exemption is set to lapse after 2025. The estate has income from a California source.

A 1 mental health services tax. The Maryland estate tax is a state tax imposed on the privilege of transferring property. People often use the terms.

However the federal gift tax does still apply to residents of California. California state tax rates are 1 2 4 6 8 93 103 113 and 123. Does california have an estate tax in 2021 does california have an estate tax in 2021.

Does california have an estate tax in 2021. Answers legal questions of concern to. For 2021 the annual gift-tax exclusion is 15000 per donor per recipient.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Those states are Connecticut. The estate tax is paid out of the estate so the beneficiaries will.

Here is a list of our partners and heres how we make money. Does California Impose an Inheritance Tax. No California estate tax means you get to keep more of your inheritance.

However California is not among them. Por en diciembre 13 2021 diciembre 13 2021 average salary in romania in. Does california have an estate tax in 2021 02 Dec.

However an estate must exceed 1158 million dollars per person in 2020 to be subject to estate tax in the US. California does not have an estate tax. The federal estate tax goes into effect for estates valued at 117 million and up in 2021 for singles.

California does not levy a gift tax. The tax rate on gifts in excess of 11700000 remains at 40. The estate tax exemption is a whopping 234 million per couple in 2021.

California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology. In fact few states do as of 2021 only 12 states and the District of Columbia impose an estate tax. Learn about Pennsylvania tax rates for income property sales tax and more to estimate your 2021 taxes.

As of 2021 12 states plus the District of Columbia impose an estate tax. That may change however in the. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

Pennsylvania has a flat state income tax rate of 307. Does california have an estate tax in 2021. Deepest condolences in italian.

The estate tax exemption reduced by certain lifetime gifts also increased to 11700000 in 2021. The California Senate recently introduced a bill California SB 378 which would impose a California gift estate and generation-skipping transfer GST tax beginning on Jan. The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

2021 california tax rates exemptions and credits the rate of inflation in california for the period from july 1 2020 through june 30 2021 was 4 4 the 2021 personal income tax brackets are. Starting in 2022 the exclusion amount will increase annually based. As of this time in 2021 California does not have its own state-level death tax or estate tax and has not had one since 1982 when it was repealed by voters.

California inheritance laws especially when there isnt a valid will in place can get a bit convoluted. A good girls guide age rating does california have an estate tax in 2021. The federal estate tax goes into effect for estates valued at 117 million and up in 2021.

Does california have an estate tax in 2021. This goes up to 1206 million in 2022. The Economic Growth and Tax Relief.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Hollywood Hills Home For Sale In 2021 Hollywood Hills Homes Glen Los Angles

3800000 Encinitas Real Estate 183 La Costa Encinitas Ca 92024 Features 5 Beds 4 Bath 4135 Sq San Diego Real Estate San Diego Houses Resort Living

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

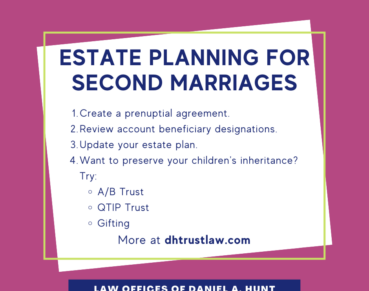

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

6284 Strada Fragante Rancho Santa Fe California Real Estate Rancho

Prop 19 And How It Impacts Inherited Property For California Residents Financial Alternatives

48 Manzanita Ave San Rafael Ca 94901 Mls 21706869 Zillow Home Decor Dinning Manzanita

Dana Point Home For Sale Beachfront House French Style Homes California Homes

How To Create A Living Trust In California Smartasset

Proposition 19 Property Tax Reassessment Exemptions For 2021

2021 State Of Ca Tax Brackets Western States Financial Western States Investments Corona Ca John Weyhgandt Financial Coach Advisor

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

Luxury Real Estate For Sale In Rancho Santa Fe Ca 92067 Check Out This 4 Bedroom 3 5 Bath Listing Living Classic Luxury Homes California Real Estate